Income Tax E Filing Tds Challan Download

Tax deducted at source (tds) under income tax- an overview Create challan form (crn) user manual Challan tds deposit vary subject

Online Income Tax Payment Challans

E-pay tax : income tax, tds through income tax portal Filing return tds What is this income tax, tds, filing that all complicate about?

Tds on non-filing of income tax return

Income tax challan 281 in excel formatHow to download tds challan and make online payment Procedure after paying challan in tdsIncome tax and tds return filing service in connaught place, delhi.

How to pay income tax through challan 280Filing tds quicko Income tax challan status: how to check tds challan status?Tds filing portal income.

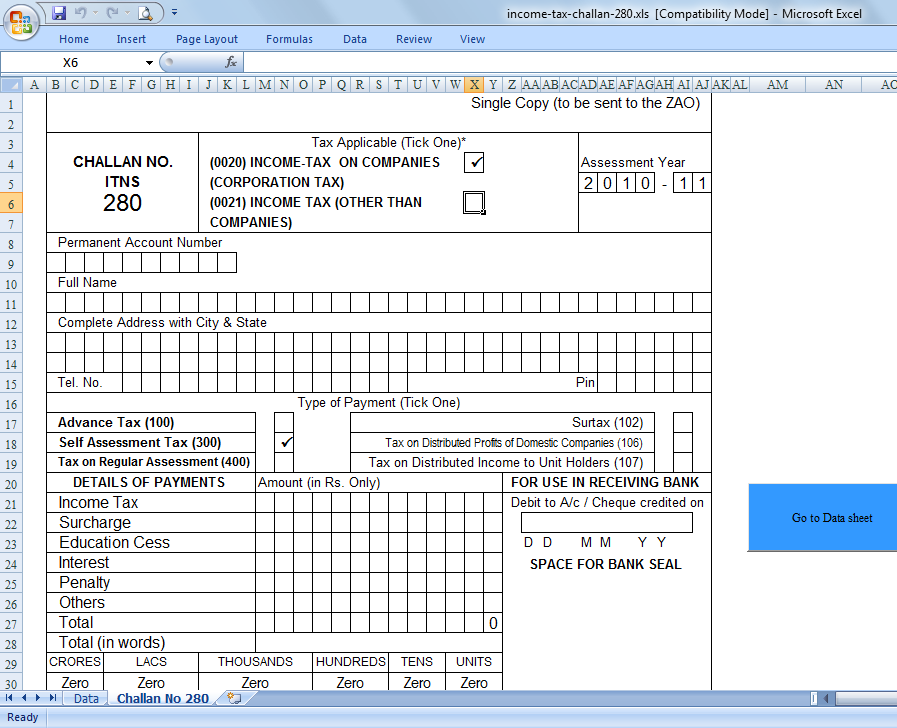

Taxblog india: income tax challan no 280 for tax payment in excel with

How to download paid tds challan and tcs challan details on e-filingChallan 280 tax income payment excel fill assessment self india auto click here amount Challan 280 income assessment offline nsdlE-pay tax : income tax, tds through income tax portal.

How to record income tax payments in tallyprime (payroll)Income tax and tds return filing service at best price in new delhi How to fill tds or tcs challan / download tds/tcs challan 281Income tax e-filing portal : view tds form.

Income tax payment challan (guide)

Form 26qd: tds on contractual/professional payments- learn by quickoOnline income tax payment challans Tds challan how to download tds challan from income tax...E-pay tax : income tax, tds through income tax portal.

Contractual tds quicko taxCreate challan form crn user manual income tax department Challan tds form tax property ia payment immovable transferChallan payroll.

Tds challan paying salary computation

Challan for payment of tds u/s 194-ia: transfer of immovable propertyHow to file tds return on e-filing portal Upload tds return on e-filing portalFree download tds challan 280 excel format for advance tax/ self.

Tds tax deducted income due ay rates checked rate following chart overview link sourceIncome tax & tds returns filing services at best price in hyderabad Income tax payment online using challan 280 step by stepTax payment over the counter user manual.

Tds challan 281: what is it and how to pay?- razorpayx

Tds return filling services at best price in ghaziabadChallan tds tcs Challan tax counterfoil income payment online taxpayer quicko learn assessment selfChallan 280: online & offline i-t payment for self-assessment.

.

Upload TDS Return on e-Filing Portal - Learn by Quicko

What is this Income tax, TDS, Filing that all complicate about?

Income tax & TDS Returns Filing services at best price in Hyderabad

Challan 280 - Income Tax Online Payment using Challan 280 - ITNS 280

How to file TDS Return on e-Filing Portal - Learn by Quicko

Taxblog India: Income tax Challan No 280 for tax payment in Excel with

Online Income Tax Payment Challans